Compliance at CardCoins

CardCoins is a US based non-bank financial institution (NBFI), which means compliance is always top of mind. But it can sometimes feel like a moving target! At any moment regulators can and do modify the requirements for crypto-focused NBFIs at the state or federal levels. This means CardCoins must regularly review and update its compliance program to keep up.

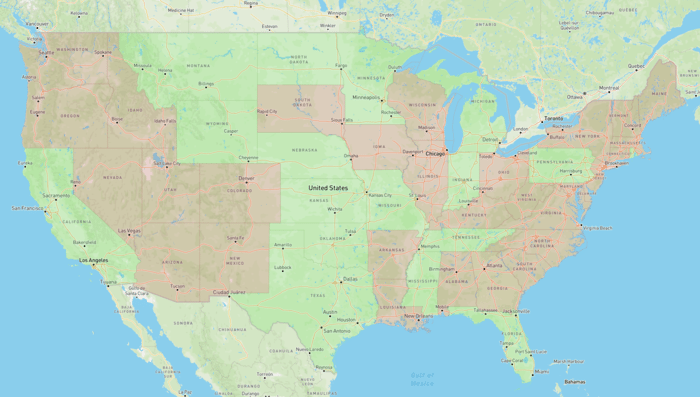

Accordingly, we are announcing changes to the list of states where we currently operate. Effective immediately CardCoins’ service will be accessible from the following states:

California, Florida, Indiana, Kansas, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, North Dakota, Oklahoma, Pennsylvania, Rhode Island, Tennessee, Texas, Wyoming

As a reminder, our geo-restrictions depend on your location when you access our website, not the retailer where your gift card was purchased. For example, if a family member purchased the gift card for you in a state we don’t support, but you access our website from a state we do support, your order will be approved! If you’re looking for a retailer near you, please use our recently optimized map!

We’ve also made some modifications to our Tier 2 and Tier 3 daily and weekly volume limits! Moving forward, Tier 2 verified customers will be able to purchase up to $2,000 of Bitcoin per day, and Tier 3 verified customers will be able to purchase up to $2,999 Bitcoin per day. Neither Tier will have a weekly limit beyond their daily volume restrictions. Please note that for Tier verification, we won’t be able to accept identification issued by states in which our services are currently restricted.

If you have questions about our compliance obligations and how they might affect you, please contact us! It is a privilege to serve our community and we will continue to do so wherever local regulations permit.